Politicians and pundits often talk about budget projections from the

CBO. Depending on how the CBO's projections mesh with the commenter's worldview, the projections are either the best possible from the nation's top budget economists, or they're crap, constrained by Congressional rules until they're useless. So just how accurate is the CBO?

A comment over at

Bob Murphy's Free Advice inspired me to check out both the

2001 and

2012 "Budget and Economic Outlook" reports from the CBO. While I've got them out, I thought it'd be interesting to compare the CBO's old projections with what actually happened. Conveniently, the 2001 and 2012 reports overlap in 2011, so that's the year I'll compare.

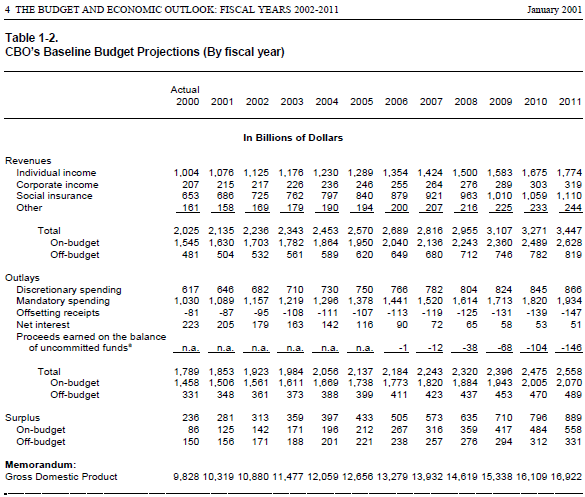

First, Table 1-2 from the

2001 report (page 24 of the PDF), including the 2001 projection for 2011 in the far-right column:

Then, Table 1 from the

2012 report (page 6 of the PDF), including the actual numbers for 2011 in the far-left column:

How accurate was the CBO for 2011? Not at all.

Revenue: The CBO projected revenues of $3.4 trillion, while actual revenues were a full third lower than the projection, at $2.3 trillion.

Outlays: The CBO projected outlays of $2.6 trillion, while actual outlays were a full trillion higher at $3.6 trillion.

Deficit: The CBO optimistically projected an $889 billion

surplus for 2011. The actual deficit was $1.3 trillion, a $2.2 trillion difference. (Of course, this error is just the combination of the two errors above. Still, it's interesting to contemplate a United States with an $889 billion surplus!)

GDP: The CBO projected a $16.9 trillion (nominal) GDP, but actual GDP was only $15.3 trillion.

Should we just write off the CBO entirely then? I don't think so. On the revenue side, the CBO could not have accounted for the Bush tax cuts or the revenue lost from the Great Recession. On the spending side, they could not have accounted for the war spending or, again, for the Great Recession, or for Obama keeping stimulus-level spending even after the stimulus was over.

I think the takeaway here, as we approach the end of the fiscal cliff negotiations, is that

all projections for a decade in the future need to be taken with a grain of salt. Stuff is going to happen that no one expects. Decide for yourself what that should mean for current policy.

A final note: Some might look at the four areas above and say that in each area, the projections ended up being more optimistic than reality. I think that's a mistake. First, the CBO projected in 2001 that 20% of 2011's GDP would be soaked up by federal taxes, when it was actually only 15%. I think that's a good thing, despite what it means for the deficit.

Second, the GDP numbers above are nominal, meaning they include both real GDP and inflation. If nominal GDP is lower than expected, the cause might be lower real GDP (bad) or lower inflation (good). We've had both in recent years, so I'd have to dig deeper into the reports to see which effect dominates, and that's more playing with PDFs than I'd like to do tonight.