Politicians and pundits often talk about budget projections from the CBO. Depending on how the CBO's projections mesh with the commenter's worldview, the projections are either the best possible from the nation's top budget economists, or they're crap, constrained by Congressional rules until they're useless. So just how accurate is the CBO?

A comment over at Bob Murphy's Free Advice inspired me to check out both the 2001 and 2012 "Budget and Economic Outlook" reports from the CBO. While I've got them out, I thought it'd be interesting to compare the CBO's old projections with what actually happened. Conveniently, the 2001 and 2012 reports overlap in 2011, so that's the year I'll compare.

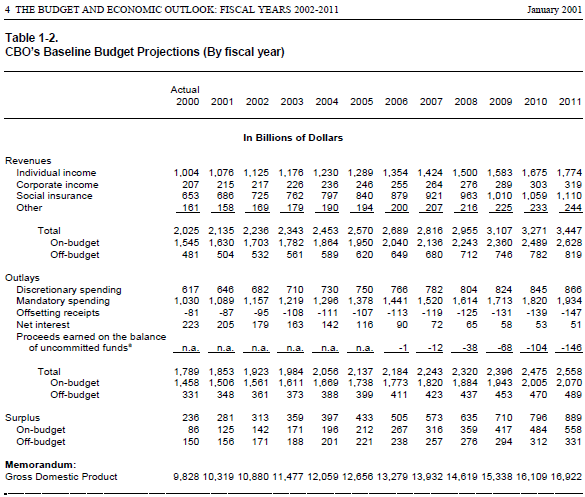

First, Table 1-2 from the 2001 report (page 24 of the PDF), including the 2001 projection for 2011 in the far-right column:

Then, Table 1 from the 2012 report (page 6 of the PDF), including the actual numbers for 2011 in the far-left column:

How accurate was the CBO for 2011? Not at all.

Revenue: The CBO projected revenues of $3.4 trillion, while actual revenues were a full third lower than the projection, at $2.3 trillion.

Outlays: The CBO projected outlays of $2.6 trillion, while actual outlays were a full trillion higher at $3.6 trillion.

Deficit: The CBO optimistically projected an $889 billion surplus for 2011. The actual deficit was $1.3 trillion, a $2.2 trillion difference. (Of course, this error is just the combination of the two errors above. Still, it's interesting to contemplate a United States with an $889 billion surplus!)

GDP: The CBO projected a $16.9 trillion (nominal) GDP, but actual GDP was only $15.3 trillion.

Should we just write off the CBO entirely then? I don't think so. On the revenue side, the CBO could not have accounted for the Bush tax cuts or the revenue lost from the Great Recession. On the spending side, they could not have accounted for the war spending or, again, for the Great Recession, or for Obama keeping stimulus-level spending even after the stimulus was over.

I think the takeaway here, as we approach the end of the fiscal cliff negotiations, is that all projections for a decade in the future need to be taken with a grain of salt. Stuff is going to happen that no one expects. Decide for yourself what that should mean for current policy.

A final note: Some might look at the four areas above and say that in each area, the projections ended up being more optimistic than reality. I think that's a mistake. First, the CBO projected in 2001 that 20% of 2011's GDP would be soaked up by federal taxes, when it was actually only 15%. I think that's a good thing, despite what it means for the deficit.

Second, the GDP numbers above are nominal, meaning they include both real GDP and inflation. If nominal GDP is lower than expected, the cause might be lower real GDP (bad) or lower inflation (good). We've had both in recent years, so I'd have to dig deeper into the reports to see which effect dominates, and that's more playing with PDFs than I'd like to do tonight.

Wednesday, December 26, 2012

Thursday, December 20, 2012

Aboriginal "Rights"

The "aboriginal rights group" Idle No More is protesting in Ottawa, including a hunger strike by Theresa Spence, chief of the Attawapiskat First Nation. Top of the list of their demands:

To make this even more disturbing, near the end of that link, Spence talks about how she is willing to die and has even said her farewells to her 17-year-old child. She is willing to starve herself to death to deny her fellow Natives the same rights non-Natives already have. With friends like that...

Perhaps it should be no surprise that, with Spence in charge, Attawapiskat receives some $10,000 per member per year from the federal government, yet the people live in squalor and last year the government required Attawapiskat to temporarily turn over their finances to a third-party manager. The surprise is that the people of Attawapiskat put up with Spence in the first place.

[Idle No More co-founder Tonya] Kappo worries that new laws outlined in Bill C-45 would clear the way for aboriginals to sell plots of their land to non-natives, threatening traditional practices and eroding their language.I don't think that word "rights" means what they think it means. The Conservative government is trying to give Natives more rights, by allowing them to sell their land to whoever they want, just like non-Natives can. Idle No More is protesting to prevent Natives from having the same rights non-Natives have always had.

“This guarantees the end of reserve lands,” Kappo told Postmedia News. “The kind of life my parents live, the kind of live our people live is only possible because of the reserve system. It’s ironic that the same system created to assimilate us is actually what has allowed us to keep our way of life.”

To make this even more disturbing, near the end of that link, Spence talks about how she is willing to die and has even said her farewells to her 17-year-old child. She is willing to starve herself to death to deny her fellow Natives the same rights non-Natives already have. With friends like that...

Perhaps it should be no surprise that, with Spence in charge, Attawapiskat receives some $10,000 per member per year from the federal government, yet the people live in squalor and last year the government required Attawapiskat to temporarily turn over their finances to a third-party manager. The surprise is that the people of Attawapiskat put up with Spence in the first place.

Tuesday, December 18, 2012

Recent Reasons for Optimism VI

While it's been awhile, I think it's time for another installment of Recent (more or less) Reasons for Optimism.

The Best of Humanity

1. Buzzfeed profiles some of the heroes of Sandy Hook. A single man embodied the worst that humanity can be and caused enormous suffering. But these six women stood up to the challenge and saved dozens of lives, some at the cost of their own.

2. Buzzfeed also has a list of "26 Moments that Restored Our Faith in Humanity." My favorites include the responses to Hurricane Sandy at #4 and #5, the man with the arthritic dog at #23, and the "parents of the year" at #24.

Health

3. This infographic, covering the leading causes of death since 1900, has some great reasons for optimism. The number one cause of death in 2010 was heart disease, but the deaths caused by heart disease have fallen steadily since their peak in the 60s, from about 370 to 193 per 100,000. Deaths from the second-worst killer, cancer, have also been falling since they peaked in the early 90s.

4. Scientists in the UK have successfully spurred nerve regeneration in paralyzed dogs by transplanting cells from the dogs' own noses to the injured areas. It remains to be seen if the technique will work in humans, but over several months, the dogs went from complete paralysis in the rear legs to being able to walk on a treadmill without assistance.

5. Jan Scheuermann, who is paralyzed from the neck down, can now operate a robotic arm using only her mind "with speeds comparable to the able-bodied" and with a 91.6% accuracy rate.

Civil Liberties

6. The Senate Judiciary Committee unanimously passed a bill that would require law enforcement to actually get warrants to read private emails, no matter how old the email is. The bill will now go to the full Senate, and if it passes there, would also need to pass the House and be signed by Obama, but at least it's a step in the right direction.

Technology

7. Self-driving cars are inching closer to reality. Ford plans to introduce cars that can drive for you in stressful stop-and-go traffic, possibly by 2015. But Volvo will beat them to the punch with cars that can drive themselves at slow speeds in 2014. Meanwhile, a company called Rio Tinto is already using ten driverless trucks to transport iron ore, with plans to expand to 150 over the next few years.

8. 3D printing is coming to a store near you, at least in Europe. Staples will be offering 3D printing services next year in The Netherlands and Belgium. No doubt the US will soon follow, if this turns out to be profitable for them. Meanwhile, Virginia Tech is providing 3D printing free for students (ht). Researchers in Britain are also having some success in printing electronics.

9. From Planetary Resources, a nearly hour-long video with a great amount of detail on the work they're doing to mine asteroids. Early in the video, Eric Anderson says, "The fact of the matter is that the population of the planet has grown a lot over the last couple hundred years, and people live longer, people live much better lives. It's really an extraordinary time to be alive. And yet, we're just at the cusp of doing some of the more incredibly exciting things that we never thought were possible before."

Some more highlights:

Economics

11. In the US, household net worth is the highest it's been since 2007, and higher than any point prior to 2006. The total value of US real estate is also on the rise for the first time since 2006.

12. Don Boudreaux is in the midst of a series of blog entries detailing how everyday items are both less expensive and higher quality today than in 1956, based on an old Sears catalog from that year. So far, he's included women's clothing, bedsheets and lawn care. Mark Perry has made similar observations using other old advertisements, including dishwashers and home entertainment.

And finally, not a reason for optimism, but rather a quote from Winston Churchill: "A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty."

The Best of Humanity

1. Buzzfeed profiles some of the heroes of Sandy Hook. A single man embodied the worst that humanity can be and caused enormous suffering. But these six women stood up to the challenge and saved dozens of lives, some at the cost of their own.

2. Buzzfeed also has a list of "26 Moments that Restored Our Faith in Humanity." My favorites include the responses to Hurricane Sandy at #4 and #5, the man with the arthritic dog at #23, and the "parents of the year" at #24.

Health

3. This infographic, covering the leading causes of death since 1900, has some great reasons for optimism. The number one cause of death in 2010 was heart disease, but the deaths caused by heart disease have fallen steadily since their peak in the 60s, from about 370 to 193 per 100,000. Deaths from the second-worst killer, cancer, have also been falling since they peaked in the early 90s.

4. Scientists in the UK have successfully spurred nerve regeneration in paralyzed dogs by transplanting cells from the dogs' own noses to the injured areas. It remains to be seen if the technique will work in humans, but over several months, the dogs went from complete paralysis in the rear legs to being able to walk on a treadmill without assistance.

5. Jan Scheuermann, who is paralyzed from the neck down, can now operate a robotic arm using only her mind "with speeds comparable to the able-bodied" and with a 91.6% accuracy rate.

Civil Liberties

6. The Senate Judiciary Committee unanimously passed a bill that would require law enforcement to actually get warrants to read private emails, no matter how old the email is. The bill will now go to the full Senate, and if it passes there, would also need to pass the House and be signed by Obama, but at least it's a step in the right direction.

Technology

7. Self-driving cars are inching closer to reality. Ford plans to introduce cars that can drive for you in stressful stop-and-go traffic, possibly by 2015. But Volvo will beat them to the punch with cars that can drive themselves at slow speeds in 2014. Meanwhile, a company called Rio Tinto is already using ten driverless trucks to transport iron ore, with plans to expand to 150 over the next few years.

8. 3D printing is coming to a store near you, at least in Europe. Staples will be offering 3D printing services next year in The Netherlands and Belgium. No doubt the US will soon follow, if this turns out to be profitable for them. Meanwhile, Virginia Tech is providing 3D printing free for students (ht). Researchers in Britain are also having some success in printing electronics.

9. From Planetary Resources, a nearly hour-long video with a great amount of detail on the work they're doing to mine asteroids. Early in the video, Eric Anderson says, "The fact of the matter is that the population of the planet has grown a lot over the last couple hundred years, and people live longer, people live much better lives. It's really an extraordinary time to be alive. And yet, we're just at the cusp of doing some of the more incredibly exciting things that we never thought were possible before."

Some more highlights:

- 17% of near-Earth asteroids are easier to reach than the surface of the moon.

- Platinum-group metals are usually mined in concentrations of a few parts per billion and have an average price of $1500 per ounce. A single 500-meter asteroid has more of these metals than have been mined from Earth in the history of humanity.

- Anderson: "Some of the naysayers to asteroid mining say, well gee, if you bring back all the platinum, then the price will crash. And I say, great. I would love to see that. I would like to see a world of abundance."

Economics

11. In the US, household net worth is the highest it's been since 2007, and higher than any point prior to 2006. The total value of US real estate is also on the rise for the first time since 2006.

12. Don Boudreaux is in the midst of a series of blog entries detailing how everyday items are both less expensive and higher quality today than in 1956, based on an old Sears catalog from that year. So far, he's included women's clothing, bedsheets and lawn care. Mark Perry has made similar observations using other old advertisements, including dishwashers and home entertainment.

And finally, not a reason for optimism, but rather a quote from Winston Churchill: "A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty."

Tuesday, December 4, 2012

Under the Protection of the State

This is absolutely disgusting (ht Bob Murphy, more here and here). Even moreso that it happened here in Washington state. In a nutshell, public schools in Longview didn't know what to do with disabled children when they acted up. So they built specially-designed "isolation rooms" and then they locked children in these padded rooms -- in some cases without parental permission, notification or even internal documentation. Now that they've been found out, the schools are "suspending" the use of solitary confinement in the padded rooms, apparently reserving the right to use them again once the media isn't watching anymore.

Furthermore, the "alternate methods" they plan to use in the meantime (including isolation in non-padded rooms, immobility holds and aversion therapy) aren't going to work either. People with cognitive disabilities don't (usually) act out because they want to be bad. They act out because they have some need that is not being met, and they don't know any other way to have that need met. Sometimes it can take a lot of time and effort to find out what that need is, or to get the person to express the need in a socially-acceptable manner, but that's why the phrase "special needs" was coined in the first place. The problem is that every one of the proposed "alternate methods" to handle these children ignores the unmet need, and therefore guarantees the bad behavior will continue.

But it gets worse. While I try not to talk about my work on this blog, I work at a company that works directly with the disabled. We are very heavily regulated and very closely monitored by the state government to ensure the rights of our disabled clients are not infringed. If we, as a private company, did anything close to what Longview public schools did, we would be shut down immediately.

But Longview public schools, as government institutions, are protected in ways that children in their care are not. As far as I can tell, apparently nothing will be done to the teachers or schools who used the isolation rooms. Police and regulators have done nothing; the only investigation has apparently been led by ABC News and the local ABC affiliate, KATU. The teachers and school administrators who locked children in the padded rooms without parental permission, who failed to notify the parents and who failed to even document the incidents (in violation of state law) will apparently not suffer any consequences at all. And that's just as disgusting as the fact that it happened in the first place.

Furthermore, the "alternate methods" they plan to use in the meantime (including isolation in non-padded rooms, immobility holds and aversion therapy) aren't going to work either. People with cognitive disabilities don't (usually) act out because they want to be bad. They act out because they have some need that is not being met, and they don't know any other way to have that need met. Sometimes it can take a lot of time and effort to find out what that need is, or to get the person to express the need in a socially-acceptable manner, but that's why the phrase "special needs" was coined in the first place. The problem is that every one of the proposed "alternate methods" to handle these children ignores the unmet need, and therefore guarantees the bad behavior will continue.

But it gets worse. While I try not to talk about my work on this blog, I work at a company that works directly with the disabled. We are very heavily regulated and very closely monitored by the state government to ensure the rights of our disabled clients are not infringed. If we, as a private company, did anything close to what Longview public schools did, we would be shut down immediately.

But Longview public schools, as government institutions, are protected in ways that children in their care are not. As far as I can tell, apparently nothing will be done to the teachers or schools who used the isolation rooms. Police and regulators have done nothing; the only investigation has apparently been led by ABC News and the local ABC affiliate, KATU. The teachers and school administrators who locked children in the padded rooms without parental permission, who failed to notify the parents and who failed to even document the incidents (in violation of state law) will apparently not suffer any consequences at all. And that's just as disgusting as the fact that it happened in the first place.

Thursday, November 29, 2012

Taxes in the Fiscal Cliff

It is becoming increasingly clear that we are not going to make it into 2013 without tax increases. If we go over the fiscal cliff, taxes are going up, but Democrats have made clear that any negotiated deal would include increased taxes as well. Assuming we do go over the cliff, what would those taxes look like?

On the other hand, even if Congress does not reach a deal to avoid the cliff, I expect a minor deal to avoid the AMT. After all, Congress has enacted one-year patches to the AMT every year for more than a decade, under both Republican and Democratic Congresses, as well as under the split control we've seen since 2010. This year should be no different.

On the Bush tax cuts, Obama was reelected after campaigning to raise taxes on the wealthy. If no deal is reached, Obama gets his wish; the Bush cuts expire and taxes are raised on the wealthy (and everyone else). The Republicans really don't have any leverage on this issue, so I expect any deal would only keep the Bush cuts for those below some income level, probably $200k or $250k.

The real uncertainty is the payroll tax cut. Normally, I would expect Democrats to abhor the cut on the grounds that it undermines Social Security. Republicans should celebrate it, not only as a tax cut, but because it undermines a massive entrenched entitlement. And yet, in some sleight of hand I still haven't figured out, Obama got the Republicans to oppose (and Democrats to support) a tax cut on every worker in the country. Now that the election is over, will the parties stick to these flipped roles, or revert to their principles? Or will the payroll tax cut expire with no one paying attention?

What Republicans Should Do

Whatever happens with the rest of the fiscal cliff, the rich (and people who work for the rich) are going to get hosed. Obama will probably get his way on the Bush tax cuts, and many of the Obamacare taxes are also aimed at the rich. Health costs are also going to go up, but I think the smart insurance companies have already raised their rates to compensate. There may not be a noticeable increase in premiums because the increase has already happened.

Given this, Republicans need to refocus on what good they can still do. Taxes are going up, and with Obama's reelection, that was inevitable. But if Republicans are smart and tactful, they can still keep taxes low for most of us. Give Obama the tax hike on the rich, since that will happen even with no deal, but secure the payroll tax cut and the Bush cuts for the non-rich in exchange. Obama himself is campaigning for the latter, so this should be easy to do, if Republicans are willing to do it.

- New Obamacare taxes would come into effect.

- The Alternative Minimum Tax would return to full strength.

- The Bush tax cuts would expire.

- The payroll tax cut would expire.

On the other hand, even if Congress does not reach a deal to avoid the cliff, I expect a minor deal to avoid the AMT. After all, Congress has enacted one-year patches to the AMT every year for more than a decade, under both Republican and Democratic Congresses, as well as under the split control we've seen since 2010. This year should be no different.

On the Bush tax cuts, Obama was reelected after campaigning to raise taxes on the wealthy. If no deal is reached, Obama gets his wish; the Bush cuts expire and taxes are raised on the wealthy (and everyone else). The Republicans really don't have any leverage on this issue, so I expect any deal would only keep the Bush cuts for those below some income level, probably $200k or $250k.

The real uncertainty is the payroll tax cut. Normally, I would expect Democrats to abhor the cut on the grounds that it undermines Social Security. Republicans should celebrate it, not only as a tax cut, but because it undermines a massive entrenched entitlement. And yet, in some sleight of hand I still haven't figured out, Obama got the Republicans to oppose (and Democrats to support) a tax cut on every worker in the country. Now that the election is over, will the parties stick to these flipped roles, or revert to their principles? Or will the payroll tax cut expire with no one paying attention?

What Republicans Should Do

Whatever happens with the rest of the fiscal cliff, the rich (and people who work for the rich) are going to get hosed. Obama will probably get his way on the Bush tax cuts, and many of the Obamacare taxes are also aimed at the rich. Health costs are also going to go up, but I think the smart insurance companies have already raised their rates to compensate. There may not be a noticeable increase in premiums because the increase has already happened.

Given this, Republicans need to refocus on what good they can still do. Taxes are going up, and with Obama's reelection, that was inevitable. But if Republicans are smart and tactful, they can still keep taxes low for most of us. Give Obama the tax hike on the rich, since that will happen even with no deal, but secure the payroll tax cut and the Bush cuts for the non-rich in exchange. Obama himself is campaigning for the latter, so this should be easy to do, if Republicans are willing to do it.

Wednesday, November 7, 2012

Final Ballot, Post-Mortem

Now that the election's over*, how did I do? Not well on candidates, but far better on the issues.

Out of 16 races with more than one candidate, the one I voted for won in only three of them. Kim Wyman's victory for Secretary of State is particularly narrow, only ~14k. If she holds onto it, however, she would be the only Republican to hold statewide office. In District 40, Jeff Morris defeated the only non-presidential third-party candidate on my ballot, the Green party's Howard Pellett.

Candidates

U.S. President: Gary Johnson (Libertarian), VP James P. Gray

U.S. Senator: Michael Baumgartner (R)

U.S. Representative: Dan Matthews (R)

WA Governor: Rob McKenna (R)

WA Lieutenant Governor: Bill Finkbeiner (R)

WA Secretary of State: Kim Wyman (R)

WA State Treasurer: Sharon Hanek (R)

WA State Auditor: James Watkins (R)

WA Attorney General: Reagan Dunn (R)

WA Commissioner of Public Lands: Clint Didier (R)

WA Superintendent of Public Instruction: Write-in, Luisa Rey

WA Insurance Commissioner: John R. Adams (R)

WA State Senator, District 40: John Swapp (Ind-R)

WA State Representative, District 40, Position 1: Write-in, Rufus Sixsmith

WA State Representative, District 40, Position 2: Jeff Morris (D)

WA Supreme Court Justice, Position 2: Write-in, Adam Ewing

WA Supreme Court Justice, Position 8: Write-in, Timothy Cavendish

WA Supreme Court Justice, Position 9: Richard B. Sanders

WA Court of Appeals Judge, Division 1, District 3, Position 1: Write-in, Robert Frobisher

Whatcom County Superior Court Judge, Position 2: Dave Grant

Public Utility District 1, Commissioner District 2: Paul D. Kenner

I had far better luck on the issues. Out of ten issues, Washington and local voters agreed with me on eight of them. The exceptions are marijuana legalization and regulation, which passed 55-44 and a new local property tax, which passed 55-45.

Issues

I-1185, Two-Thirds Tax Requirement: Yes

I-1240, Charter Schools: Yes

R-74, Same-sex Marriage: Approved

I-502, Marijuana: No

SJR-8221, Altering the Debt Limit: Approved

SJR-8223, Public Fund Investments: Rejected

A-1, B&O Tax Increase: Repeal

A-2, Petroleum Tax: Repeal

Port of Bellingham, Prop-1, Number of Port Commissioners: No

City of Bellingham, Prop-1, Low-Income Housing Levy: No

*Since Washington is a 100% vote-by-mail state, and the last day for the ballot to be postmarked was election day, there may be up to two million ballots out there floating through the postal system, waiting to be counted. These results are, therefore, only provisional.

Out of 16 races with more than one candidate, the one I voted for won in only three of them. Kim Wyman's victory for Secretary of State is particularly narrow, only ~14k. If she holds onto it, however, she would be the only Republican to hold statewide office. In District 40, Jeff Morris defeated the only non-presidential third-party candidate on my ballot, the Green party's Howard Pellett.

Candidates

WA Secretary of State: Kim Wyman (R)

WA State Representative, District 40, Position 2: Jeff Morris (D)

Public Utility District 1, Commissioner District 2: Paul D. Kenner

I had far better luck on the issues. Out of ten issues, Washington and local voters agreed with me on eight of them. The exceptions are marijuana legalization and regulation, which passed 55-44 and a new local property tax, which passed 55-45.

Issues

I-1185, Two-Thirds Tax Requirement: Yes

I-1240, Charter Schools: Yes

R-74, Same-sex Marriage: Approved

SJR-8221, Altering the Debt Limit: Approved

SJR-8223, Public Fund Investments: Rejected

A-1, B&O Tax Increase: Repeal

A-2, Petroleum Tax: Repeal

Port of Bellingham, Prop-1, Number of Port Commissioners: No

*Since Washington is a 100% vote-by-mail state, and the last day for the ballot to be postmarked was election day, there may be up to two million ballots out there floating through the postal system, waiting to be counted. These results are, therefore, only provisional.

Aftermath: Reflections on Obama's Re-election

Barack Obama has been re-elected President of the United States.

For starters, Gary Johnson was not a spoiler. While the results are still coming in, as of 11:30pm Pacific, there was not a single state won by Obama where Romney would have won even if every Johnson voter had voted for Romney instead.

Second, there is no mandate. While Obama won, he won with a far narrower lead in both the popular vote and the electoral college than he had in 2008. While Democrats increased their lead in the Senate, Republicans increased their lead in governorships, and the House is on track to be more or less the same as it was. This was very much a status quo election.

On the whole, will we be better or worse with Obama as president?

First of all, expect the fiscal cliff to stay in place. After all, we just re-elected most of the people who put it there to begin with. While I haven't spent too much time learning about the fiscal cliff, Wikipedia claims a 19.63% increase in revenue and a 0.25% decrease in spending, or a nearly 80-to-1 ratio of tax hikes to spending cuts. This will not end well-- and even if our new old government leaders manage to avoid the cliff, the re-elected Obama is in a prime position to extract concessions he was unable to before the election. Any compromise will include more tax hikes than spending cuts, if spending is actually cut at all.

Second, Obamacare will be implemented fully over the next few years. Expect the nation's health, freedom and balance sheet to all suffer. Although to be honest, I don't believe Romney would have done any better.

The national debt will continue to grow. If the fiscal cliff causes a second recession, expect more stimulus and bailouts, probably for Europe too. We may look back at $1.5 trillion deficits and laugh about how small they were. On the other hand, the same probably would've happened under Romney, considering his plan to index military spending to 4% of GDP.

On other long-term important issues, I don't expect Obama to do much of anything. He'll keep ignoring space (mercifully), Social Security will continue to stumble forward without reform, trade deals will be forgotten, immigration won't change. We'll mostly withdraw from Afghanistan on schedule, although the lack of attention the war gets these days means we'll probably keep troops there for the long haul, same as we've still got troops in Germany, Japan and Korea. On trade and Afghanistan, at least, Romney would have been even worse. While Romney may have avoided the fiscal cliff, his insistence to go after China on trade might have been just as bad for the economy.

The main difference between the two candidates in terms of our long-term welfare is this: With Obama's victory, 2016 will see another wide-open primary for Republicans, where we'll have another shot at nominating a true spokesperson for liberty. Had Romney won, we wouldn't get that chance until 2020. So hold onto your hats. It's gonna be a rough four years for liberty, but we made it through the last four. We'll make it this time, too.

For starters, Gary Johnson was not a spoiler. While the results are still coming in, as of 11:30pm Pacific, there was not a single state won by Obama where Romney would have won even if every Johnson voter had voted for Romney instead.

Second, there is no mandate. While Obama won, he won with a far narrower lead in both the popular vote and the electoral college than he had in 2008. While Democrats increased their lead in the Senate, Republicans increased their lead in governorships, and the House is on track to be more or less the same as it was. This was very much a status quo election.

On the whole, will we be better or worse with Obama as president?

First of all, expect the fiscal cliff to stay in place. After all, we just re-elected most of the people who put it there to begin with. While I haven't spent too much time learning about the fiscal cliff, Wikipedia claims a 19.63% increase in revenue and a 0.25% decrease in spending, or a nearly 80-to-1 ratio of tax hikes to spending cuts. This will not end well-- and even if our new old government leaders manage to avoid the cliff, the re-elected Obama is in a prime position to extract concessions he was unable to before the election. Any compromise will include more tax hikes than spending cuts, if spending is actually cut at all.

Second, Obamacare will be implemented fully over the next few years. Expect the nation's health, freedom and balance sheet to all suffer. Although to be honest, I don't believe Romney would have done any better.

The national debt will continue to grow. If the fiscal cliff causes a second recession, expect more stimulus and bailouts, probably for Europe too. We may look back at $1.5 trillion deficits and laugh about how small they were. On the other hand, the same probably would've happened under Romney, considering his plan to index military spending to 4% of GDP.

On other long-term important issues, I don't expect Obama to do much of anything. He'll keep ignoring space (mercifully), Social Security will continue to stumble forward without reform, trade deals will be forgotten, immigration won't change. We'll mostly withdraw from Afghanistan on schedule, although the lack of attention the war gets these days means we'll probably keep troops there for the long haul, same as we've still got troops in Germany, Japan and Korea. On trade and Afghanistan, at least, Romney would have been even worse. While Romney may have avoided the fiscal cliff, his insistence to go after China on trade might have been just as bad for the economy.

The main difference between the two candidates in terms of our long-term welfare is this: With Obama's victory, 2016 will see another wide-open primary for Republicans, where we'll have another shot at nominating a true spokesperson for liberty. Had Romney won, we wouldn't get that chance until 2020. So hold onto your hats. It's gonna be a rough four years for liberty, but we made it through the last four. We'll make it this time, too.

Monday, November 5, 2012

Final Ballot

One last post about the election before it's all over tomorrow (hopefully): My completed ballot. If you're in Washington, or even Whatcom county or Bellingham, feel free to make things easier on yourself by just voting the same as me!

A note on the write-ins: As a matter of democratic principle, I refuse to vote for anyone running unopposed. Back in Ohio, that meant I just didn't vote in some races. Here in Washington, every race allows write-ins, so I'm writing in some names to register my displeasure with the unopposed candidates.

Candidates

U.S. President: Gary Johnson (Libertarian), VP James P. Gray

U.S. Senator: Michael Baumgartner (R)

U.S. Representative: Dan Matthews (R)

WA Governor: Rob McKenna (R)

WA Lieutenant Governor: Bill Finkbeiner (R)

WA Secretary of State: Kim Wyman (R)

WA State Treasurer: Sharon Hanek (R)

WA State Auditor: James Watkins (R)

WA Attorney General: Reagan Dunn (R)

WA Commissioner of Public Lands: Clint Didier (R)

WA Superintendent of Public Instruction: Write-in, Luisa Rey

WA Insurance Commissioner: John R. Adams (R)

WA State Senator, District 40: John Swapp (Ind-R)

WA State Representative, District 40, Position 1: Write-in, Rufus Sixsmith

WA State Representative, District 40, Position 2: Jeff Morris (D)

WA Supreme Court Justice, Position 2: Write-in, Adam Ewing

WA Supreme Court Justice, Position 8: Write-in, Timothy Cavendish

WA Supreme Court Justice, Position 9: Richard B. Sanders

WA Court of Appeals Judge, Division 1, District 3, Position 1: Write-in, Robert Frobisher

Whatcom County Superior Court Judge, Position 2: Dave Grant

Public Utility District 1, Commissioner District 2: Paul D. Kenner

Issues

I-1185, Two-Thirds Tax Requirement: Yes

I-1240, Charter Schools: Yes

R-74, Same-sex Marriage: Approved

I-502, Marijuana: No

SJR-8221, Altering the Debt Limit: Approved

SJR-8223, Public Fund Investments: Rejected

A-1, B&O Tax Increase: Repeal

A-2, Petroleum Tax: Repeal

Port of Bellingham, Prop-1, Number of Port Commissioners: No

City of Bellingham, Prop-1, Low-Income Housing Levy: No

A note on the write-ins: As a matter of democratic principle, I refuse to vote for anyone running unopposed. Back in Ohio, that meant I just didn't vote in some races. Here in Washington, every race allows write-ins, so I'm writing in some names to register my displeasure with the unopposed candidates.

Candidates

U.S. President: Gary Johnson (Libertarian), VP James P. Gray

U.S. Senator: Michael Baumgartner (R)

U.S. Representative: Dan Matthews (R)

WA Governor: Rob McKenna (R)

WA Lieutenant Governor: Bill Finkbeiner (R)

WA Secretary of State: Kim Wyman (R)

WA State Treasurer: Sharon Hanek (R)

WA State Auditor: James Watkins (R)

WA Attorney General: Reagan Dunn (R)

WA Commissioner of Public Lands: Clint Didier (R)

WA Superintendent of Public Instruction: Write-in, Luisa Rey

WA Insurance Commissioner: John R. Adams (R)

WA State Senator, District 40: John Swapp (Ind-R)

WA State Representative, District 40, Position 1: Write-in, Rufus Sixsmith

WA State Representative, District 40, Position 2: Jeff Morris (D)

WA Supreme Court Justice, Position 2: Write-in, Adam Ewing

WA Supreme Court Justice, Position 8: Write-in, Timothy Cavendish

WA Supreme Court Justice, Position 9: Richard B. Sanders

WA Court of Appeals Judge, Division 1, District 3, Position 1: Write-in, Robert Frobisher

Whatcom County Superior Court Judge, Position 2: Dave Grant

Public Utility District 1, Commissioner District 2: Paul D. Kenner

Issues

I-1185, Two-Thirds Tax Requirement: Yes

I-1240, Charter Schools: Yes

R-74, Same-sex Marriage: Approved

I-502, Marijuana: No

SJR-8221, Altering the Debt Limit: Approved

SJR-8223, Public Fund Investments: Rejected

A-1, B&O Tax Increase: Repeal

A-2, Petroleum Tax: Repeal

Port of Bellingham, Prop-1, Number of Port Commissioners: No

City of Bellingham, Prop-1, Low-Income Housing Levy: No

Tuesday, October 30, 2012

No on Two Local Issues

With exactly a week before my ballot has to be back in the

government's hands, I'm filling it out a bit faster now. So far I've voted yes

on I-1185, I-1240 and SJR-8221, approved R-74 and voted no on I-502, SJR-8223, A-1 and A-2. Below are two local issues, one for the Port of Bellingham and one for the City of Bellingham.

NO on Port of Bellingham, Proposition 1, Number of Port Commissioners

The Issue: There are currently three Port of Bellingham Commissioners; this proposition would raise that number to five.

My Position: While the official argument for Prop-1 speaks of increased representation, this smells to me like an attempt to pack the commission. I can find no clear evidence for or against my hypothesis, but it still smells like a fish to me. Plus, Washington's open meetings law applies to one-on-one meetings of a three-member commission; it does not apply to one-on-one meetings of a five-member commission. That smells even fishier. I will be voting NO on the Port's Prop-1.

NO on City of Bellingham, Proposition 1, Low-Income Housing Levy

The Issue: City Council wants to raise property taxes by $36 per $100,000 of assessed value to fund a program for low-income housing.

My Position: I will be voting no on this tax increase, for three reasons:

1) An increase in the property tax will increase rent, and I don't want my rent to go up.

2) Trying to make housing more affordable by raising taxes on housing is just plain stupid. As the official "Statement Against" says, "You don't make housing more affordable by making it more expensive."

3) The state and federal governments already provide low-income housing subsidies, as well as other programs for low-income people. Do we really need yet another level of government doing the same thing as the others?

NO on Port of Bellingham, Proposition 1, Number of Port Commissioners

The Issue: There are currently three Port of Bellingham Commissioners; this proposition would raise that number to five.

My Position: While the official argument for Prop-1 speaks of increased representation, this smells to me like an attempt to pack the commission. I can find no clear evidence for or against my hypothesis, but it still smells like a fish to me. Plus, Washington's open meetings law applies to one-on-one meetings of a three-member commission; it does not apply to one-on-one meetings of a five-member commission. That smells even fishier. I will be voting NO on the Port's Prop-1.

NO on City of Bellingham, Proposition 1, Low-Income Housing Levy

The Issue: City Council wants to raise property taxes by $36 per $100,000 of assessed value to fund a program for low-income housing.

My Position: I will be voting no on this tax increase, for three reasons:

1) An increase in the property tax will increase rent, and I don't want my rent to go up.

2) Trying to make housing more affordable by raising taxes on housing is just plain stupid. As the official "Statement Against" says, "You don't make housing more affordable by making it more expensive."

3) The state and federal governments already provide low-income housing subsidies, as well as other programs for low-income people. Do we really need yet another level of government doing the same thing as the others?

No on Three Minor Statewide Issues

With exactly a week before my ballot has to be back in the

government's hands, I'm filling it out a bit faster now. So far I've voted yes

on I-1185, I-1240 and SJR-8221, approved R-74 and voted no on I-502. Below are three minor statewide issues: SJR-8223 on public fund investments, plus two advisory votes.

NO on SJR-8223, Public Fund Investments

The Issue: In general, Washington state public funds are prohibited from investing in private stocks and bonds. Over time, a laundry list of exceptions has been added to the constitution, primarily allowing public trust funds and public pension funds to invest in private stocks and bonds. SJR-8223 would add the operating budgets of the University of Washington and Washington State University to the list of exceptions.

My Position: Using public funds to invest in private companies looks to me like a backdoor way to pick winners and losers with voters none-the-wiser. I think the general prohibition is a great idea, and that we should probably reduce the list of restrictions rather than increase it.

REPEAL A-1, B&O Tax Increase

The Issue: The Washington legislature raised B&O taxes on some financial institutions and lowered taxes for others, including manufacturers of agriculture products and newspapers, for a net 10-year tax increase of $24 million.

My Position: Tax increases in general are bad. This one in particular is worse. It raises taxes on a disfavored industry (finance) by $170 million, and mostly offsets it with cuts to favored industries (agriculture, newspapers). While this is only an advisory vote, I will vote to repeal to send a message against tax increases and against favors to certain industries over others.

REPEAL A-2, Petroleum Tax

The Issue: A tax on certain commercial petroleum products was set to expire, and the Washington legislature extended the expiration date for a 10-year tax increase of $24 million.

My Position: Once again, tax increases are bad. While A-2 is not as bad as A-1, I will still vote to repeal to send a message against tax increases.

NO on SJR-8223, Public Fund Investments

The Issue: In general, Washington state public funds are prohibited from investing in private stocks and bonds. Over time, a laundry list of exceptions has been added to the constitution, primarily allowing public trust funds and public pension funds to invest in private stocks and bonds. SJR-8223 would add the operating budgets of the University of Washington and Washington State University to the list of exceptions.

My Position: Using public funds to invest in private companies looks to me like a backdoor way to pick winners and losers with voters none-the-wiser. I think the general prohibition is a great idea, and that we should probably reduce the list of restrictions rather than increase it.

REPEAL A-1, B&O Tax Increase

The Issue: The Washington legislature raised B&O taxes on some financial institutions and lowered taxes for others, including manufacturers of agriculture products and newspapers, for a net 10-year tax increase of $24 million.

My Position: Tax increases in general are bad. This one in particular is worse. It raises taxes on a disfavored industry (finance) by $170 million, and mostly offsets it with cuts to favored industries (agriculture, newspapers). While this is only an advisory vote, I will vote to repeal to send a message against tax increases and against favors to certain industries over others.

REPEAL A-2, Petroleum Tax

The Issue: A tax on certain commercial petroleum products was set to expire, and the Washington legislature extended the expiration date for a 10-year tax increase of $24 million.

My Position: Once again, tax increases are bad. While A-2 is not as bad as A-1, I will still vote to repeal to send a message against tax increases.

Yes on SJR-8221, Altering the Debt Limit

With about a week before my ballot has to be back in the

government's hands, I'm filling it out bit by bit. So far I've voted yes

on I-1185 and I-1240, approved R-74 and voted no on I-502.

SJR-8221, Altering the Debt Limit

The Issue: Engrossed Senate Joint Resolution 8221 is a constitutional amendment implementing three changes to the Washington state limit on debt payments:

1) The amendment would schedule three reductions to the state debt limit. Currently at 9.0% of general state revenues, the limit would fall to 8.5% in 2014, 8.25% in 2016 and 8.0% in 2034 (and no, that's not a typo, that's a reduction scheduled for twenty-two years after the amendment).

2) The current limit is based on the average of general state revenues over the previous three years. The amendment would change that to six years.

3) Whereas "general state revenues" currently only includes revenue that is not dedicated to a specific use, the amendment would redefine "general state revenues" to include the state property tax, which is dedicated to the specific use of funding public schools.

My Position: I'm no fan of government debt, and Washington state debt is already over 20% of GSP. I wholeheartedly support lowering the limit on state debt.

The Changes:

1) While scheduling the final drop to 8.0% for 2034 is nothing but cynical, a drop to 8.5% at the next biennial budget and 8.25% at the biennial budget after that is a clear win for smaller government.

2) Extending the the basis for the limit from the average of three years to six years stabilizes the limit against recessions. However, since revenue typically grows year-to-year, the six-year average will usually be smaller than the three-year average. The debt limit will be a smaller percentage of a smaller number-- again, a win for smaller government.

3) Expanding the definition of "general state revenues" to include property taxes further stabilizes the limit, as property taxes are more stable than other forms of revenue. However, this also raises the limit. The Commission on State Debt (PDF) found that property taxes are about 10% of general state revenue, but typically grow slower (2%) than the rest of general state revenue (4.5%). Even so, if these numbers hold true, the new limit would be about 2.5% lower than the old in 2014, and would drop to almost 6% lower than the old in 2016. Once again, a win for small government.

I will be voting YES on SJR-8221.

SJR-8221, Altering the Debt Limit

The Issue: Engrossed Senate Joint Resolution 8221 is a constitutional amendment implementing three changes to the Washington state limit on debt payments:

1) The amendment would schedule three reductions to the state debt limit. Currently at 9.0% of general state revenues, the limit would fall to 8.5% in 2014, 8.25% in 2016 and 8.0% in 2034 (and no, that's not a typo, that's a reduction scheduled for twenty-two years after the amendment).

2) The current limit is based on the average of general state revenues over the previous three years. The amendment would change that to six years.

3) Whereas "general state revenues" currently only includes revenue that is not dedicated to a specific use, the amendment would redefine "general state revenues" to include the state property tax, which is dedicated to the specific use of funding public schools.

My Position: I'm no fan of government debt, and Washington state debt is already over 20% of GSP. I wholeheartedly support lowering the limit on state debt.

The Changes:

1) While scheduling the final drop to 8.0% for 2034 is nothing but cynical, a drop to 8.5% at the next biennial budget and 8.25% at the biennial budget after that is a clear win for smaller government.

2) Extending the the basis for the limit from the average of three years to six years stabilizes the limit against recessions. However, since revenue typically grows year-to-year, the six-year average will usually be smaller than the three-year average. The debt limit will be a smaller percentage of a smaller number-- again, a win for smaller government.

3) Expanding the definition of "general state revenues" to include property taxes further stabilizes the limit, as property taxes are more stable than other forms of revenue. However, this also raises the limit. The Commission on State Debt (PDF) found that property taxes are about 10% of general state revenue, but typically grow slower (2%) than the rest of general state revenue (4.5%). Even so, if these numbers hold true, the new limit would be about 2.5% lower than the old in 2014, and would drop to almost 6% lower than the old in 2016. Once again, a win for small government.

I will be voting YES on SJR-8221.

No on I-502, Marijuana

With about a week before my ballot has to be back in the

government's hands, I'm filling it out bit by bit. So far I've voted yes

on both I-1185 and I-1240, and approved R-74.

I-502, Marijuana

The Issue: I-502 would make it legal under state law (but not federal law) to possess and sell marijuana under a system of strict regulations. Marijuana producers could not have any financial interest in marijuana retailers and vice versa. Licenses to produce, process or retail marijuana would cost $250 to apply plus $1000 per year per location, with samples regularly submitted to state labs for testing.

Furthermore, marijuana would be taxed at 25% at each level of production and distribution, prior to state and local B&O and sales taxes. At the legally-mandated minimum of two steps of production (producer -> retailer), state taxes on marijuana would be approximately 68%. Total tax, including the state average for local sales taxes, would be over 70%.

I-502 also establishes many alcohol-equivalent rules for marijuana use. For example, marijuana possession would remain illegal for those under 21, driving under the influence of marijuana would be illegal for everyone, open containers in public would be prohibited, etc. The pro-502 website is here. The official anti-502 website, which is pro-legalization, is here.

My Position: I don't fully buy the arguments supporting the drug war, but I also don't buy a lot of the arguments opposing it. My libertarian leanings run up against path dependency, and I remain agnostic on the drug war as a whole.

I am opposed to I-502 because it won't bring any of the benefits of legalization, yet will create a massive new state bureaucracy under the guise of legalization.

My Reasons:

1) I-502 will directly contradict federal law, under which marijuana production, distribution and possession will all remain illegal. If passed, the initiative is likely to be struck down entirely or in part in federal court. (The counterargument is that I-502 allows but does not require violations of federal law, so that it is not pre-empted and will not be struck down. However, I-502 does seem to require violations of federal law by state marijuana regulators, particularly the prohibitions on possession and distribution of marijuana. The feds may also consider it money laundering to accept funds raised from the marijuana tax.)

2) Even if I-502 is not struck down, the threat of federal prosecution for marijuana crimes will prevent the benefits of legalization from being realized. Licensed marijuana producers, processors and retailers will have their names, addresses and precise details of their businesses recorded in a state database. Any guesses on how long it takes that database to get into federal hands? Anyone who opens a marijuana business is betting big on that never happening. New producers will be discouraged from entering the market; existing producers will be discouraged from becoming licensed.

3) Furthermore, the regulatory system set up by I-502 will place legal marijuana sellers at a substantial disadvantage to illegal sellers. Legal marijuana sales will have a cumulative tax of at least 68%, and possibly more than 100% if the production and distribution chain contains more than two steps. Then there's the significant regulatory burden placed on legal sellers-- the fees they must pay to the government, or to third parties because of government requirements; the restrictions on where they can sell, where and how they can advertise, what other businesses they can be involved in; and all of it with the threat of federal prosecution still hanging over their heads. Again, new producers will be discouraged from entering the market, and existing producers will be discouraged from becoming licensed.

4) The existing (illegal) marijuana market is an international one, yet legal marijuana sellers under I-502 will be limited to Washington state, both in who they buy from and who they sell to. With the other disadvantages placed on legal sellers, they will never be able to compete with existing illegal sellers, and those illegal sellers have scant incentive to become legal.

Whatever benefits full legalization might provide, we won't see any of them under I-502. Meanwhile, the state will spend tens of millions of dollars setting up a bureaucracy to regulate a market that will likely fail to materialize.

I will be voting NO on I-502.

I-502, Marijuana

The Issue: I-502 would make it legal under state law (but not federal law) to possess and sell marijuana under a system of strict regulations. Marijuana producers could not have any financial interest in marijuana retailers and vice versa. Licenses to produce, process or retail marijuana would cost $250 to apply plus $1000 per year per location, with samples regularly submitted to state labs for testing.

Furthermore, marijuana would be taxed at 25% at each level of production and distribution, prior to state and local B&O and sales taxes. At the legally-mandated minimum of two steps of production (producer -> retailer), state taxes on marijuana would be approximately 68%. Total tax, including the state average for local sales taxes, would be over 70%.

I-502 also establishes many alcohol-equivalent rules for marijuana use. For example, marijuana possession would remain illegal for those under 21, driving under the influence of marijuana would be illegal for everyone, open containers in public would be prohibited, etc. The pro-502 website is here. The official anti-502 website, which is pro-legalization, is here.

My Position: I don't fully buy the arguments supporting the drug war, but I also don't buy a lot of the arguments opposing it. My libertarian leanings run up against path dependency, and I remain agnostic on the drug war as a whole.

I am opposed to I-502 because it won't bring any of the benefits of legalization, yet will create a massive new state bureaucracy under the guise of legalization.

My Reasons:

1) I-502 will directly contradict federal law, under which marijuana production, distribution and possession will all remain illegal. If passed, the initiative is likely to be struck down entirely or in part in federal court. (The counterargument is that I-502 allows but does not require violations of federal law, so that it is not pre-empted and will not be struck down. However, I-502 does seem to require violations of federal law by state marijuana regulators, particularly the prohibitions on possession and distribution of marijuana. The feds may also consider it money laundering to accept funds raised from the marijuana tax.)

2) Even if I-502 is not struck down, the threat of federal prosecution for marijuana crimes will prevent the benefits of legalization from being realized. Licensed marijuana producers, processors and retailers will have their names, addresses and precise details of their businesses recorded in a state database. Any guesses on how long it takes that database to get into federal hands? Anyone who opens a marijuana business is betting big on that never happening. New producers will be discouraged from entering the market; existing producers will be discouraged from becoming licensed.

3) Furthermore, the regulatory system set up by I-502 will place legal marijuana sellers at a substantial disadvantage to illegal sellers. Legal marijuana sales will have a cumulative tax of at least 68%, and possibly more than 100% if the production and distribution chain contains more than two steps. Then there's the significant regulatory burden placed on legal sellers-- the fees they must pay to the government, or to third parties because of government requirements; the restrictions on where they can sell, where and how they can advertise, what other businesses they can be involved in; and all of it with the threat of federal prosecution still hanging over their heads. Again, new producers will be discouraged from entering the market, and existing producers will be discouraged from becoming licensed.

4) The existing (illegal) marijuana market is an international one, yet legal marijuana sellers under I-502 will be limited to Washington state, both in who they buy from and who they sell to. With the other disadvantages placed on legal sellers, they will never be able to compete with existing illegal sellers, and those illegal sellers have scant incentive to become legal.

Whatever benefits full legalization might provide, we won't see any of them under I-502. Meanwhile, the state will spend tens of millions of dollars setting up a bureaucracy to regulate a market that will likely fail to materialize.

I will be voting NO on I-502.

Saturday, October 27, 2012

Approve R-74, Same Sex Marriage

With less than two weeks before my ballot has to be back in the government's hands, I'm filling it out bit by bit. So far I've voted yes on both I-1185 and I-1240.

R-74, Same Sex Marriage

The Issue: R-74 is a referendum on Senate Bill 6239, which extended the legal term "marriage" to include relationships previously included only under the term "domestic partnership" and restricted the term "domestic partnership" so that it would not overlap the term "marriage." SB-6239 also granted special immunities to clergy and religious organizations to preserve their right to not perform or recognize any particular marriage.

SB-6239 was signed into law by Governor Gregoire in February of this year. Opponents gathered enough petition signatures to require a referendum; that referendum is R-74. Approval means the law will be enacted; rejection means it will not be enacted. The pro-approval website is here; the pro-rejection website is here.

My Position: Whether or not to marry and who we marry if we do is one of the most deeply personal choices we can make, and the government has no place in it. Unfortunately, that option isn't on the table.

Current law in Washington has already established same-sex "domestic partnerships" which are legally equivalent to marriage in all but name. R-74 is not about relationships or love or God's will or anything else its supporters and detractors claim. Everything that could happen under R-74 would also happen without it. R-74 is a very narrow question that is entirely linguistic: Should the legal term "marriage" also refer to what are now same-sex domestic partnerships?

Twice now, I've deliberately referred to "marriage" as a legal term, because in this instance, that is all that it is. State law cannot change the popular meaning of a word, only its use in legal terminology. I don't care one way or the other about legal terminology. A rose by any other name...

However, R-74 also grants special protections to religious organizations to preserve their right to not perform or recognize same-sex marriages. This provision gets closer to my ideal marriage policy than any other proposal I've ever seen-- You should be free to marry whoever you want, and I should be free to acknowledge or ignore it however I want. I would prefer if these protections were granted to everyone, not just religious organizations. Even so, R-74 enshrines the right to disagree, and this, I think, is a very important first step towards my ideal.

I will be voting APPROVE on R-74.

R-74, Same Sex Marriage

The Issue: R-74 is a referendum on Senate Bill 6239, which extended the legal term "marriage" to include relationships previously included only under the term "domestic partnership" and restricted the term "domestic partnership" so that it would not overlap the term "marriage." SB-6239 also granted special immunities to clergy and religious organizations to preserve their right to not perform or recognize any particular marriage.

SB-6239 was signed into law by Governor Gregoire in February of this year. Opponents gathered enough petition signatures to require a referendum; that referendum is R-74. Approval means the law will be enacted; rejection means it will not be enacted. The pro-approval website is here; the pro-rejection website is here.

My Position: Whether or not to marry and who we marry if we do is one of the most deeply personal choices we can make, and the government has no place in it. Unfortunately, that option isn't on the table.

Current law in Washington has already established same-sex "domestic partnerships" which are legally equivalent to marriage in all but name. R-74 is not about relationships or love or God's will or anything else its supporters and detractors claim. Everything that could happen under R-74 would also happen without it. R-74 is a very narrow question that is entirely linguistic: Should the legal term "marriage" also refer to what are now same-sex domestic partnerships?

Twice now, I've deliberately referred to "marriage" as a legal term, because in this instance, that is all that it is. State law cannot change the popular meaning of a word, only its use in legal terminology. I don't care one way or the other about legal terminology. A rose by any other name...

However, R-74 also grants special protections to religious organizations to preserve their right to not perform or recognize same-sex marriages. This provision gets closer to my ideal marriage policy than any other proposal I've ever seen-- You should be free to marry whoever you want, and I should be free to acknowledge or ignore it however I want. I would prefer if these protections were granted to everyone, not just religious organizations. Even so, R-74 enshrines the right to disagree, and this, I think, is a very important first step towards my ideal.

I will be voting APPROVE on R-74.

Friday, October 26, 2012

Yes on I-1240, Charter Schools

With less than two weeks before my ballot has to be back in the government's hands, I'm filling it out bit by bit. Voting Yes on I-1185 was easy; I-1240 is more difficult.

I-1240, Charter Schools

The Issue: I-1240 would create a "new" type of public school, one managed by a non-religious, non-profit organization, yet funded by the state government. Forty-one other states have adopted charter schools; I-1240 would allow a total of 40 charter schools in Washington. The pro-1240 website is here; the anti-1240 website is here.

My Position: In general, I support increasing school choice. In this particular case, I'm a bit leery for a few reasons. However, any reform that provides more choice is a step in the right direction, so I support I-1240.

My Reservations: I have three main concerns about I-1240:

1) Washington's charter schools will be explicity non-religious. Now under current Supreme Court doctrine, we may not have any other choice, but it still concerns me. If I-1240 passes, Washington will be establishing a program to give tax money to private organizations, and explicitly excluding certain organizations from consideration for that money based soley on religion. (On the other hand, it's not like regular public schools are any better in that regard, and at least I-1240 will expand parental choice.)

2) Washington's charter schools can only be run by non-profits. By removing the profit motive, I-1240 removes one of the best advantages charter schools have over regular public schools. (On the other hand, Washington voters have already rejected charter schools three times. Non-profit charters may be the only kind of charter school we can hope to see here in the near future.)

3) I would prefer a full voucher system that allowed parents the full range of choices for their children's education. (On the other hand, realistically, that's not going to happen any time soon, at least not in Washington state.)

Counterarguments: The No-on-1240 side makes four main counterarguments against I-1240, quoted below from the official Argument Against published in the voters' pamphlet:

1) "Charter schools will drain millions of dollars from existing public schools." (Rebuttal: In Washington, public school funding is based on enrollment. If a student enrolls in a different public school, the money follows the student. Charter schools will take money from existing schools only to the extent that parents choose charter schools over existing schools.)

2) "Charter schools will serve only a tiny fraction of our student population." (Rebuttal: Since school funding follows the student, this means that only a tiny fraction of public school money will be taken from existing schools. So what's the problem? I have a hard time taking this counterargument seriously. If the problem is that only a few would benefit, what kind of solution is it to forbid those few from benefiting?)

3) "Charter schools are an unproven, risky gamble." (Rebuttal: Forty-one states plus DC have already adopted charter schools, some more than twenty years ago. You might say compact discs are unproven, risky gambles too. But seriously, regular public schools are a gamble too-- some fail spectacularly. The difference is that you currently can't leave a public school without shelling out thousands to a private school or homeschooling. The parents' option to exit will not only keep charter schools on their toes, but improve performance in non-charter schools as well.)

4) "Charter schools undermine local control." (Rebuttal: I should hope so! If I were a parent, I wouldn't want the local board to have such total control over where I educated my children. I-1240 only undermines "local control" insofar as it restores choice to parents.)

I will be voting YES on I-1240.

I-1240, Charter Schools

The Issue: I-1240 would create a "new" type of public school, one managed by a non-religious, non-profit organization, yet funded by the state government. Forty-one other states have adopted charter schools; I-1240 would allow a total of 40 charter schools in Washington. The pro-1240 website is here; the anti-1240 website is here.

My Position: In general, I support increasing school choice. In this particular case, I'm a bit leery for a few reasons. However, any reform that provides more choice is a step in the right direction, so I support I-1240.

My Reservations: I have three main concerns about I-1240:

1) Washington's charter schools will be explicity non-religious. Now under current Supreme Court doctrine, we may not have any other choice, but it still concerns me. If I-1240 passes, Washington will be establishing a program to give tax money to private organizations, and explicitly excluding certain organizations from consideration for that money based soley on religion. (On the other hand, it's not like regular public schools are any better in that regard, and at least I-1240 will expand parental choice.)

2) Washington's charter schools can only be run by non-profits. By removing the profit motive, I-1240 removes one of the best advantages charter schools have over regular public schools. (On the other hand, Washington voters have already rejected charter schools three times. Non-profit charters may be the only kind of charter school we can hope to see here in the near future.)

3) I would prefer a full voucher system that allowed parents the full range of choices for their children's education. (On the other hand, realistically, that's not going to happen any time soon, at least not in Washington state.)

Counterarguments: The No-on-1240 side makes four main counterarguments against I-1240, quoted below from the official Argument Against published in the voters' pamphlet:

1) "Charter schools will drain millions of dollars from existing public schools." (Rebuttal: In Washington, public school funding is based on enrollment. If a student enrolls in a different public school, the money follows the student. Charter schools will take money from existing schools only to the extent that parents choose charter schools over existing schools.)

2) "Charter schools will serve only a tiny fraction of our student population." (Rebuttal: Since school funding follows the student, this means that only a tiny fraction of public school money will be taken from existing schools. So what's the problem? I have a hard time taking this counterargument seriously. If the problem is that only a few would benefit, what kind of solution is it to forbid those few from benefiting?)

3) "Charter schools are an unproven, risky gamble." (Rebuttal: Forty-one states plus DC have already adopted charter schools, some more than twenty years ago. You might say compact discs are unproven, risky gambles too. But seriously, regular public schools are a gamble too-- some fail spectacularly. The difference is that you currently can't leave a public school without shelling out thousands to a private school or homeschooling. The parents' option to exit will not only keep charter schools on their toes, but improve performance in non-charter schools as well.)

4) "Charter schools undermine local control." (Rebuttal: I should hope so! If I were a parent, I wouldn't want the local board to have such total control over where I educated my children. I-1240 only undermines "local control" insofar as it restores choice to parents.)

I will be voting YES on I-1240.

Wednesday, October 24, 2012

Yes on I-1185, the Two-Thirds Tax Requirement

The election is upon us! In recent days I have received both the poorly-named, 143-page voters' "pamphlet" with sample ballot as well as my actual ballot. I have until 8pm on Election Day to get it back to the government, so it's time to do my homework. First up is an easy one:

I-1185, the Two-Thirds Tax Requirement

The Issue: Current law in Washington state requires tax increases to be passed with a two-thirds majority in both houses of the state legislature, or by a simple majority in a popular vote. This law has been passed four times by popular initiative, most recently in 2007 and 2010. It was overturned by the legislature upon losing initiative protection in 2010. I-1185 renews the law to prevent it from being overturned in 2013. The pro-1185 website is here; the anti-1185 website is here.

My Position: I wholeheartedly support I-1185, and indeed any law that provides a check on the government's ability to take my money at will. The two-thirds requirement makes it more likely that taxes will only be raised when it truly is necessary.

Counterarguments: There seem to be four main arguments against I-1185:

1) Taxes should be higher, and I-1185 makes it more difficult to raise them as high as they should be, negatively impacting government services. (Rebuttal: No, taxes should not be higher. Important services can be funded by cutting non-important spending. If everything the government is doing is so important that none of it can be cut, then it should be easy to get a two-thirds vote in the legislature or a simple majority popular vote.)

2) I-1185 is unfair because it allows tax cuts & loopholes to be passed with a simple majority, but reversing those cuts & loopholes requires a two-thirds majority. (Rebuttal: This is true, but I have to admit, I'm just fine with a system that's biased towards letting me keep more of my own money.)

3) A two-thirds requirement is undemocratic. (Rebuttal: I-1185 allows tax increases via direct, simply majority popular votes. Nothing could be more democratic than that.)

4) A two-thirds requirement is unconstitutional. (Rebuttal: I would certainly prefer a constitutional amendment that does what I-1185 does, but constitutional amendments must be proposed by the legislature, and wouldn't you know it, they don't seem to like amendments that limit their own power. If an initiative as beneficial as I-1185 actually is unconstitutional, that would be a failure of the state constitution, not the initiative.)

I will be voting YES on I-1185.

I-1185, the Two-Thirds Tax Requirement

The Issue: Current law in Washington state requires tax increases to be passed with a two-thirds majority in both houses of the state legislature, or by a simple majority in a popular vote. This law has been passed four times by popular initiative, most recently in 2007 and 2010. It was overturned by the legislature upon losing initiative protection in 2010. I-1185 renews the law to prevent it from being overturned in 2013. The pro-1185 website is here; the anti-1185 website is here.

My Position: I wholeheartedly support I-1185, and indeed any law that provides a check on the government's ability to take my money at will. The two-thirds requirement makes it more likely that taxes will only be raised when it truly is necessary.

Counterarguments: There seem to be four main arguments against I-1185:

1) Taxes should be higher, and I-1185 makes it more difficult to raise them as high as they should be, negatively impacting government services. (Rebuttal: No, taxes should not be higher. Important services can be funded by cutting non-important spending. If everything the government is doing is so important that none of it can be cut, then it should be easy to get a two-thirds vote in the legislature or a simple majority popular vote.)

2) I-1185 is unfair because it allows tax cuts & loopholes to be passed with a simple majority, but reversing those cuts & loopholes requires a two-thirds majority. (Rebuttal: This is true, but I have to admit, I'm just fine with a system that's biased towards letting me keep more of my own money.)

3) A two-thirds requirement is undemocratic. (Rebuttal: I-1185 allows tax increases via direct, simply majority popular votes. Nothing could be more democratic than that.)

4) A two-thirds requirement is unconstitutional. (Rebuttal: I would certainly prefer a constitutional amendment that does what I-1185 does, but constitutional amendments must be proposed by the legislature, and wouldn't you know it, they don't seem to like amendments that limit their own power. If an initiative as beneficial as I-1185 actually is unconstitutional, that would be a failure of the state constitution, not the initiative.)

I will be voting YES on I-1185.

Tuesday, August 21, 2012

The Elite Eight

This blog has been on an unintentional summer hiatus the past some weeks, thanks to a combination of great weather, longer work hours and several friends' weddings on the other side of the country. A lot has happened politically in the meantime, much of it worth ignoring, but there is a semi-recent piece of news about the 2008 presidential election that I really should cover. And no, I don't mean that one.

Back on August 9th, we here in Washington state found out the list of candidates who passed certification and will appear on our ballot. It's no secret I don't like Romney, and I definitely don't like Obama either. Lucky for me, there are six other tickets on the ballot. Since most outlets are only going cover two, maybe three of these candidates, I present for your informational pleasure the eight candidates for President of the United States:

Ross C. (Rocky) Anderson, Justice Party

VP: Luis J. Rodriguez

Do they have the ballot access to win? Yes, just barely, with 26 states and exactly 270 EVs, counting write-in states.

Links: Justice Party's official site, Facebook, Twitter

Rocky Anderson's official site, Facebook, Twitter

General impression: Left of Obama, but mostly within mainstream liberalism.

Party slogan: "Economic, environmental and social justice for all."

Virgil Goode, Constitution Party

VP: James N. Clymer

Do they have the ballot access to win? Unclear, although possible; aiming for 40 states.

Links: Constitution Party's official site, Facebook, Twitter

Virgil Goode's official site, Facebook, Twitter

General impression: Mostly paleoconservative, but likes entitlements.

Campaign slogan: "Save America, citizenship matters."

James Harris, Socialist Workers Party

VP: Alyson Kennedy

Do they have the ballot access to win? Unlikely; aiming for just 8 states plus write-ins.

Links: The best I can find is The Militant, a weekly newspaper closely associated with the Socialist Workers Party. Neither the party nor the campaign seem to have an online presence outside The Militant.

General impression: Socialist focusing on union and race issues.